Five wealth-building essentials

Building wealth comes down to a simple formula – spend less than you earn and invest the difference.

If you don’t have a budget or track your expenses, now is a great time to start. Never underestimate the importance of a budget in helping you take control of your finances, cash flow management, wealth management, and build your wealth.

Remember the five wealth building essentials

These form the foundations for successful investing. They are relevant for all ages, stages and markets.

1. The right balance

All investing involves some risk. The potential for higher returns also generally means an increased chance of higher negative returns. You need to strike a comfortable balance between the level of risk you are prepared to accept and your desired level of return. Your investment timeframe and risk profile will both be important in working out the right balance for you.

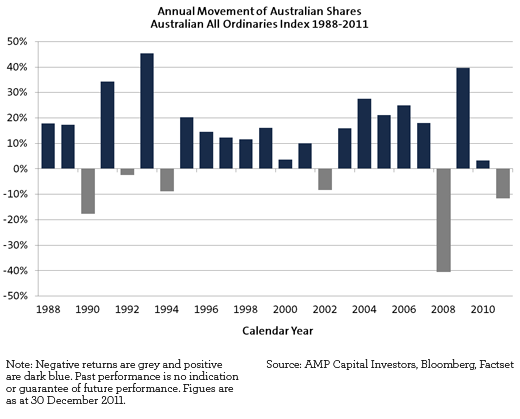

History shows while share prices may fall in the short term, over the long term the returns are higher than less risky investments like cash and fixed interest. If you have a long-term strategy, it’s important to keep this in mind and not be distracted by market down turns that, while disconcerting, are a normal part of the economic cycle.

2. A good mix

Spreading your money across a variety of investments can help lower investment risks as the values of different types of assets usually rise and fall at different times. Diversification generally reduces the impact any single investment or asset type has on your portfolio. The right mix can help ensure you have exposure to growth assets as well as more defensive assets to provide more stable returns.

3. After tax returns

Tax applies to different investments in different ways. Some investments, like super, enjoy tax advantages.

You should consider the tax impact of capital gains tax, income tax, as well as offsets and deductions when making or switching investments. While before-tax returns might make one investment look better than another, it’s usually the after-tax results that make the difference.

4. ‘Super-size’ your investment

Investing over a longer period and reinvesting returns can help you super-size, or boost, your investment through compound returns. Your money starts working harder for you by earning returns on your initial investment as well as on earlier returns you have reinvested.

5. Contribute regularly

Rather than waiting to have a lump sum to invest, you might reap real benefits by investing smaller, regular amounts over a longer timeframe – also known as dollar cost averaging. As markets move up and down, you will sometimes buy at higher prices and sometimes at lower prices. So the price you’ll pay over time will be averaged out. You can also benefit from compound returns as each contribution has the opportunity to start generating earnings immediately.

What you need to know

Any advice in this document is general in nature and is provided by AMP Life Limited ABN 84 079 300 379 (AMP Life). The advice does not take into account your personal objectives, financial situation or needs. Therefore, before acting on this advice, you should consider the appropriateness of this advice having regard to those matters and consider the Product Disclosure Statement before making a decision about the product.

AMP Life is part of the AMP Group and can be contacted on 1300 157 173 or amp.com.au/enquiry. If you decide to purchase or vary a financial product, AMP Life and/or other companies within the AMP Group will receive fees and other benefits, which will be a dollar amount or a percentage of either the premium you pay or the value of your investments. You can ask us for more details