Do you or someone in your care have a permanent incapacity and receive the Disability Support Pension?

As you approach Age Pension age, you (or they) will be invited to transfer to the Age Pension 13 weeks before reaching age 67.

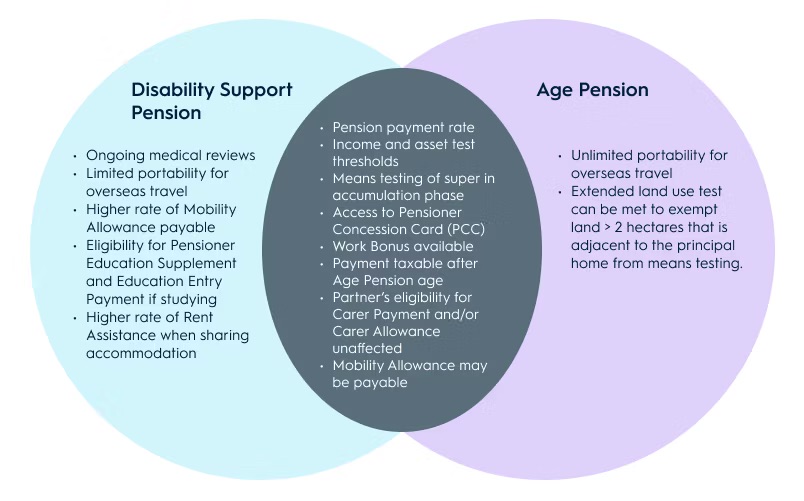

While there are commonalities between the two payments, notably the payment rates and means testing thresholds, the key differences relate to the continuity of the payment when overseas and the requirement for ongoing medical reviews.

The attached diagram provided by AMP’s technical team TapIn, outlines the key points of comparison between the payments which can help you decide whether to remain on the Disability Support Pension in your retirement or transfer to the Age Pension.

Everyone’s circumstances differ; however, it will always be useful to discuss these options with your financial planner.

Irrespective of your decision, you will need to provide Centrelink with details of any superannuation held in the accumulation phase which becomes assessable from age 67.

The information contained in this article is general information only. It is not intended to be a recommendation, offer, advice or invitation to purchase, sell or otherwise deal in securities or other investments. Before making any decision in respect to a financial product, you should seek advice from an appropriately qualified professional. We believe that the information contained in this document is accurate. However, we are not specifically licensed to provide tax or legal advice and any information that may relate to you should be confirmed with your tax or legal adviser.